For many South African personal trainers, growth doesn’t stall because of poor coaching, weak marketing, or a lack of clients. It stalls due to payment bottlenecks – a problem that no one talks about. Yet it lurks quietly in the background and inside WhatsApp chats and banking apps. It’s there.

If you’ve ever typed “Just checking if you managed to make that EFT?” and immediately felt uncomfortable, you already understand the issue. It’s not just awkward; it slowly strains your momentum, hinders professionalism, and drains your energy. The most frustrating part? Your clients aren’t bad payers; they just don’t all want to pay by card.

Then, there’s the technical danger and audit risk. With unrecorded EFT payments in your business ledger, it’s not just an admin slip – it’s a compliance liability. And in a SARS-regulated environment, it can threaten your business’s sustainability.

The EFT Reality Most Global Apps Don’t Understand

In South Africa, paying via EFT is a deliberate choice. Clients prefer a payment option that gives them control, visibility, comfort – to pay when it suits them best. For recurring services like personal training, many actively avoid using card debits. They don’t want surprise deductions, additional fees, or long-term permissions they can’t easily manage.

This preference runs across income brackets and age groups; a cultural trend, so to speak. But most fitness platforms, however, are designed around markets where card usage is the default. Stripe, PayPal, and USD-based billing structures on global PT apps assume that clients are comfortable entering card details upfront and allowing recurring charges.

And when that assumption doesn’t match reality, friction creeps in. Clients delay payment because EFT feels manual. Proof of payment arrives as screenshots. Reconciliations happen in your head. Follow-ups become personal instead of professional. But none of this will break your business overnight; it will, however, make growth heavier than it needs to be.

Why “Just Accept Cards” Isn’t the Answer

Card payments, on paper, seem like the clean, modern solution. In practice, they introduce their own set of challenges for South African solopreneurs. International processing fees add up quickly when you’re billing smaller amounts on a recurring basis. Paying 1.5% to 3.5% in fees seems little at first, until you multiply them across monthly packages, hybrid sessions, and group classes.

There’s also a trust gap. Many clients are far more hesitant to store card details on platforms that aren’t local, don’t bill in rands, or don’t integrate cleanly with South African banks – they “feel foreign”. The result? Checkout hesitation, abandoned sign-ups, and requests to “rather just EFT.” When friction appears at the payment step, momentum is lost before the relationship has even started.

The Compliance Gap & Data Responsibility

Another layer that often goes unspoken is data responsibility. Global card processors typically store payment and user data on servers in the US or Europe. For SA personal trainers working with sensitive personal and health-related info, this can quietly introduce a POPIA compliance gap.

This combo of cost pressure, client resistance, and compliance uncertainty is mainly why most personal trainers end up running two systems at once: a global app for programming and a manual “system” for payments. That duplication is where admin fatigue, missed payments, and operational stress begin to creep in.

BNK Connect approaches the problem differently by keeping payments local, structured, SARS-ready, and compliant – without forcing behaviour that doesn’t fit the South African market.

Payment Friction Leaks, Drips, Accumulates

Payment friction is rarely a dramatic explosion. It’s subtle – creeping in, slowly but surely. One late payment that slips through. Another invoice you forgot to send. An hour a week is spent manually checking transactions. Over time, those leaks turn into:

- Unpredictable cash flow

- Lost revenue you can’t quite track

- A sense that you’re always “behind” on admin

The core problem isn’t accepting EFTs themselves; it’s the lack of structure around how EFTs are handled. Manual systems rely on memory and are hardly sustainable for long-term usage in growing small businesses. For scalable businesses, you must rely on workflows.

Automated ZAR Payments: What It Actually Fixes

Enter automated payments. Automation does not remove EFT from the equation; it removes the administrative (and emotional) weight around it. When invoices are sent automatically, clearly priced in rands, and paired with neutral reminders, the payment process becomes guided rather than chased.

With automated payments, clients receive:

- A professional invoice in ZAR

- Familiar payment options

- Clear due dates and expectations

In turn, trainers gain:

- Real-time visibility into who has paid

- Fewer uncomfortable follow-ups

- More predictable monthly income

- Audit-ready annual ledgers

- Overall financial hygiene

For trainers, having an audit-ready paper trail makes the February 2026 tax deadline a breeze! No more digging through bank statements to match “Proof of Payments” with outstanding payments. The shift to automated payments alone will transform your business’s sustainability, making it far easier to run – and ultimately, grow!

The Game Changer: Where BNK Connect Fits In

First off, BNK Connect isn’t a global platform adjusted for South Africans. Its core design starts with a local banking environment: invoices are issued in rands, payment workflows respect customer preferences, and “EFT behaviour” is expected and catered for. Our system assumes that not every client wants to use a card and builds around that reality.

Instead of forcing card captures, BNK Connect supports structured invoicing with automated reminders and clear payment tracking. Trainers no longer need to check bank statements manually or remember who promised to pay “later today.” Everything lives in one place – manageable and under one roof.

Transparency: BNK Connect Adds A Layer of Trust

BNK Connect also adds a deeper layer of trust through Web3-enabled verification. Unlike manual receipts or loosely tracked transfers, which can be edited or disrupted, BNK Connect payments create a permanent record of transactions that can’t be quietly altered after the fact.

This builds confidence for clients over time and creates a “verified business” trail – a clear, provable record of professional activity, consistency, and reliability. In an industry like personal training, where trust often relies on word of mouth or screenshots, that kind of transparency sets your business apart from the rest.

BNK Connect turns billing into more than an admin task. By combining local payment logic with modern verification, it becomes a foundation for credibility, compliance, and long-term growth. All, without adding complexity to the day-to-day workflow.

Professional Invoicing That’s Human, Not Corporate

Many independent trainers avoid proper invoicing because it feels cold or overly formal. Spreadsheets feel friendlier at first. An AR or ageing report. Simple. Until the client base grows, then chaos.

BNK Connect keeps invoicing simple without stripping away professionalism. Invoices can be linked directly to sessions, packages, or recurring services. They’re sent automatically, tracked, and followed up – everything is automated.

With our platform, clients experience clarity. Trainers regain headspace. No more second-guessing or follow-ups. No more admin- “guilt” and responsibility.

Solopreneurs: Why Automated ZAR Payments Matter

If your client base is under ten, manual EFTs are manageable. At twenty, they become noisy. At fifty, they become risky. Growth magnifies whatever system you’re using, and if the system relies on memory, growth magnifies stress.

Automated ZAR payment workflows allow personal trainers to sell packages confidently, introduce billing without forcing cards, and separate personal relationships from financial admin.

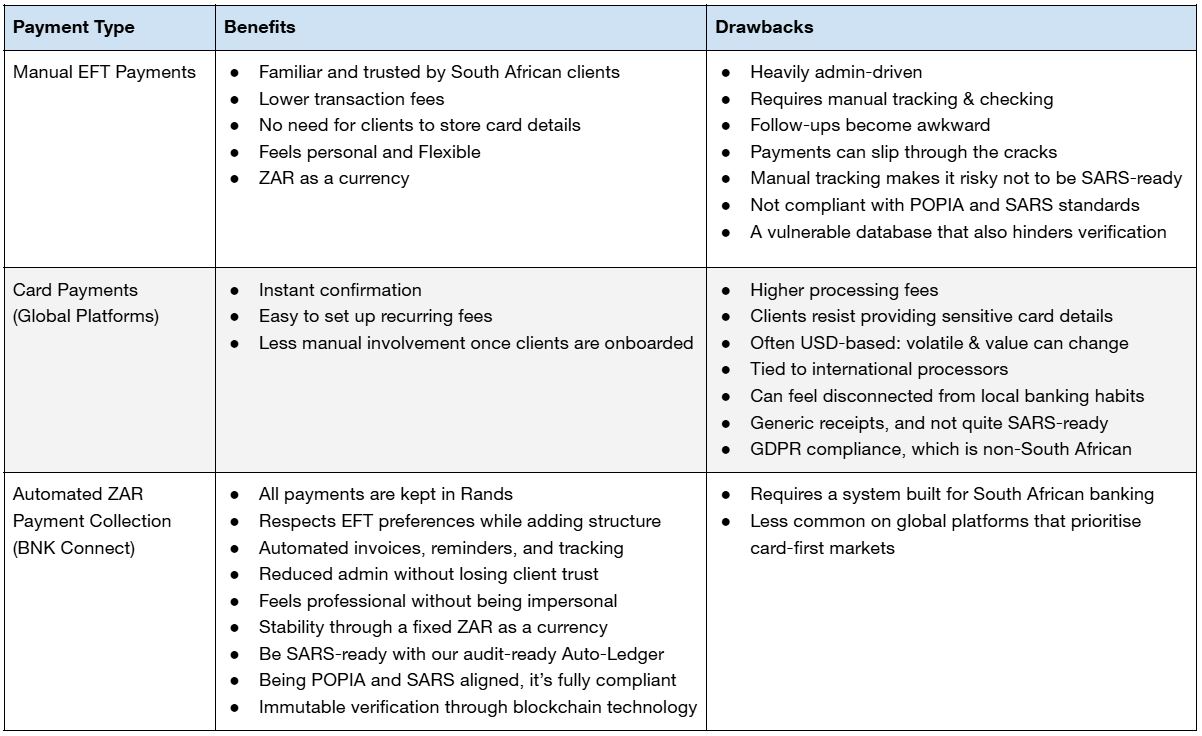

EFT & Card Payments vs Automated ZAR Collection

To truly understand why payment structure matters so much, it helps to look at EFT, card payments, and automated ZAR payment collection, side by side – not in terms of feature lists, but in day-to-day reality. While card-only platforms are optimised for scale in global markets, ZAR-first systems, such as BNK Connect, are optimised for trust in local ones.

Here’s how each one plays out in real life:

BNK Connect structures EFT into a proper payment workflow. With invoices that go out automatically, reminders as follow-up (without the emotion), and payments tracked in one place, it aligns with how South African clients already prefer to pay.

The result? Fewer late payments. Fewer uncomfortable conversations. Clearer cash flow. It’s a business that feels easier to run as it grows. BNK Connect doesn’t try to change how South Africans pay; it simply removes the taxing chaos around it.

“Free” Global Tools: The Hidden Cost No One Talks About

At first, global apps look affordable – until exchange rates shift, fees stack up, and features don’t quite fit “local is lekker” needs. The truth? South African trainers often end up paying more in time and effort than they would with a system built for their environment.

Without a streamlined ZAR-friendly platform, problems show up in currency clarity, payment habits, and client confidence, especially during the checkout process. Opting, instead, for a low-fee fitness payment system in ZAR isn’t just about lower percentages; it’s about efficiency.

Scaling Isn’t About More Clients – It’s About Less Admin

Most trainers don’t need more features. They need fewer loose ends. When bookings, invoicing, and payments are connected, errors drop, and confidence rises. Admin fatigue disappears, and you earn more trust with your customers. The result: more clients will be attracted to you and the services you offer.

BNK Connect ties everything together: scheduling, communication, invoicing, and payment tracking, into one flow that supports growth without the complexities.

Stop Chasing EFT Payments & Start Structuring

Chasing EFTs is a symptom of a much bigger problem. The real issue is the lack of a structured payment system. Automated ZAR billing changes the relationship between trainers and money. It removes payment friction, restores predictability, and promotes growth without forcing clients to use payment methods they don’t prefer.

And once payments stop “leaking energy”, everything else moves so much faster.

If you’re a South African personal trainer who wants to scale without friction, BNK Connect is designed for you, and for how the local market really works.